The FCC’s National Broadband Plan (NBP) recommends that the Commission make available 500 MHz of new spectrum for wireless broadband, including 300 MHz for mobile use. In support of that recommendation, on October 21, the FCC released an FCC Omnibus Broadband Initiative technical paper: Mobile Broadband: The Benefits of Additional Spectrum. The paper concludes that mobile data demand is likely to exceed capacity in the near term and, in particular, that the spectrum deficit is likely to approach 300 MHz by 2014.

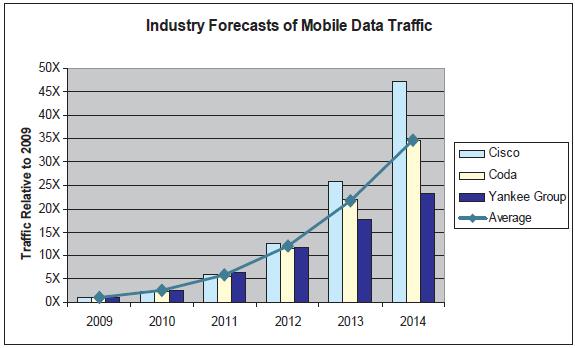

The methodology described in the paper is relatively straightforward and pragmatic, in contrast to methodologies used by other spectrum estimates cited in the NBP. The paper looks at current spectrum use and adjusts it upward based on forecasts of mobile data demand, downward based on air-interface spectral-efficiency improvements, and downward based on increased cell-site density. With such an approach, the demand forecasts are critical. Forecasts from Cisco Systems, Coda Research, and Yankee Group are used and averaged to get a single forecast.

Related to the 300 MHz estimate, directly or indirectly, are the three items the FCC has placed on the tentative agenda for its November 30 meeting: TV spectrum innovation, opportunistic spectrum use, and experimental licensing rules. Perhaps as part of one of these proceedings, the FCC will seek comment on the paper and the three forecasts. Here are some areas for consideration:

- Rate plans. The paper says, “projections of mobile data demand used in this analysis are based in part on historic market dynamics, such as ‘all you can eat’ pricing for data.” There is anecdotal evidence, however, of movement toward “pay as you go” pricing.

- Offloading of mobile broadband data onto Wi-Fi and other technologies. The paper chooses to not consider such offloading “directly.” Certain of the forecasts consider it, but incompletely, at least from what I can tell (see the last point below). As we see improvements in, and deployment of, interworking technologies for Wi-Fi and 4G, and perhaps more rationalization of rate plans away from “all you can eat” single flat rates, consumers will have more incentive to offload mobile broadband data. A reference cited by the paper downplays this effect by saying that a mobile user is often not near a Wi-Fi hotspot. The Cisco forecast, however, cites data showing that most mobile broadband use is at home or at work — locations increasingly having hotspot coverage.

- Scenarios for mobile broadband video use. Cisco predicts that video will account for 66% of mobile data traffic by 2014. It also predicts that in 2014, smartphones will use 21% of mobile data traffic and “laptops and other mobile ready portables” will use 70%. Looked at another way, video on laptops and portables is predicted to consume almost half of mobile broadband data. If we reconsider offloading of data and rate plans, estimates of mobile broadband video use can likewise be reconsidered.

- New technology. The paper looks at improvements in technology and the resulting increased spectral efficiency with respect to the air interface. Other technologies have the potential to reduce the number of bits needed to do the same thing. For example, video and audio compression technology continues to improve. What practical advances can be realized and when? Related to new technology, I’d also include software improvements resulting in reduced application data requirements and phone operating system overhead. If the industry is moving toward “pay as you go,” programmers will have greater incentive to reduce unnecessary data overhead.

- Use of non-public data. Many references cited by the paper or in the forecasts are described as proprietary or unpublished or are accessible only at considerable cost. Perhaps the FCC can encourage these sources to make more data publicly available.

There’s more that could be said about the technical paper and the three forecasts, but the above points are the first considerations that come to mind.