The Global mobile Suppliers Association (GSA), representing mobile industry vendors, has commissioned a report on opportunities in LTE broadcasting. Prepared by a UK business consultancy, it’s part marketing document making a case for impressive growth in the LTE Broadcast business, which in turn makes it a useful sales tool for GSA members.

LTE Broadcast, also called LTE Multicast, is enabled by 3GPP’s specifications for Evolved Multimedia Broadcast/Multicast Service for LTE (eMBMS). The report says it’s time for LTE Broadcast to get traction for several reasons, the most important being that, starting with 3GPP Release 12, broadcast capacity can be allocated dynamically between unicast and broadcast. (There are also proprietary solutions offering this capability.) In previous releases, broadcast capacity was reserved even if not being used.

There isn’t much available in the way of user devices but that’s changing. The report discusses chipset availability and has a list of devices containing compatible chips. Apple is conspicuously absent from any of these lists. Frequency band support in a device is sometimes region-specific but doesn’t have to be so limited if demand is there.

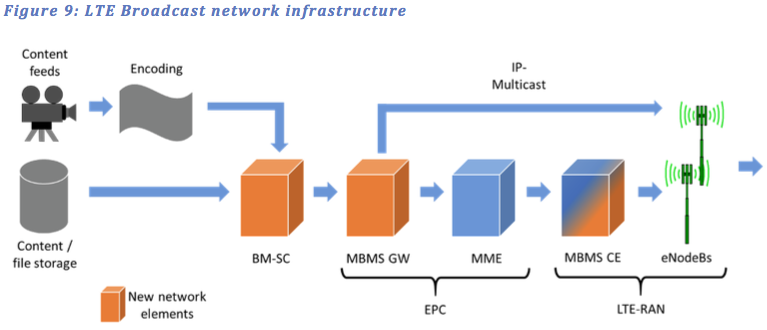

The report looks at what’s needed in the way of operator network upgrades. Key new network elements include a Broadcast Multicast Service Center (BM-SC) managing, among other things, authentication and content packaging. A Multimedia Broadcast Gateway (MBMS GW) delivers content to the relevant base stations. A MBMS Coordination Entity (MBMS CE) schedules RF resources.

There are quite a few survey results in the report, including a couple on operator plans based on slightly more than 50 respondents (I wonder where those surveyed operators are located). Consumers were surveyed on things like desirability of content pre-downloads; I’m not sure consumers know what that means, so I would have liked to have seen the questions.

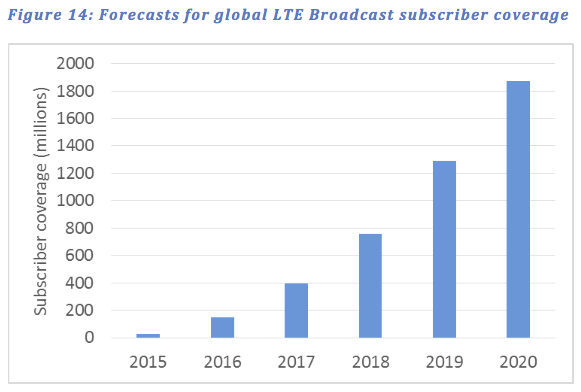

So, how big a business is this? The consultant’s forecast based on the total market for five modeled LTE Broadcast services is about $14 billion globally by the end of 2020, reaching nearly 2 billion people. (The modeled services are mobile TV, pre-downloads, travel, stadium TV, and in-car.)

The report includes a business-case checklist. (It helps to be a content holder.) An argument for first-mover advantage is made. The report also argues for savings from reduced traffic in the network; by not having to stream the same thing separately to unicast users, unicast infrastructure investment can be deferred.

The report is free from GSA but registration is required.